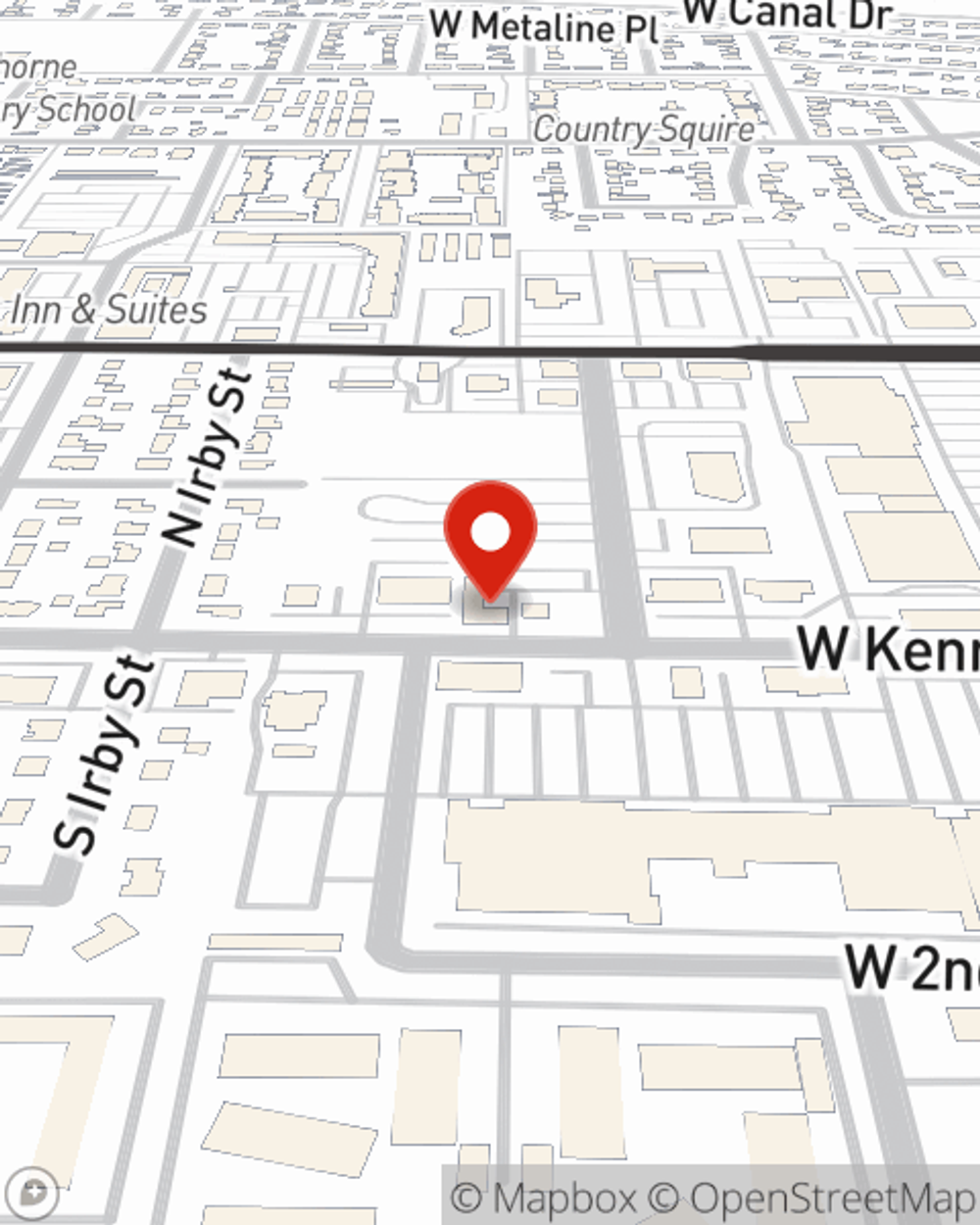

Renters Insurance in and around Kennewick

Welcome, home & apartment renters of Kennewick!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

Home is home even if you are leasing it. And whether it's a house or an apartment, protection for your personal belongings is beneficial, even if your landlord doesn’t require it.

Welcome, home & apartment renters of Kennewick!

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented townhome include a wide variety of things like your tool set, bed, tablet, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Adela Valencia has the dedication and experience needed to help you understand your coverage options and help you keep your things safe.

Renters of Kennewick, get in touch with Adela Valencia's office to explore your particular options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Adela at (509) 783-2800 or visit our FAQ page.

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Adela Valencia

State Farm® Insurance AgentSimple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.